In a world where every penny counts, the allure of business with a compassionate touch is undeniable. The age-old adage that “there’s no sentiment in business” is tested as never before, especially in the face of a global economic crunch. Especially now more than ever, the tendency to drive business with the “human face” per se is very tempting but how affected with the ways things are economically or empathetic can one be at the expense of their business.

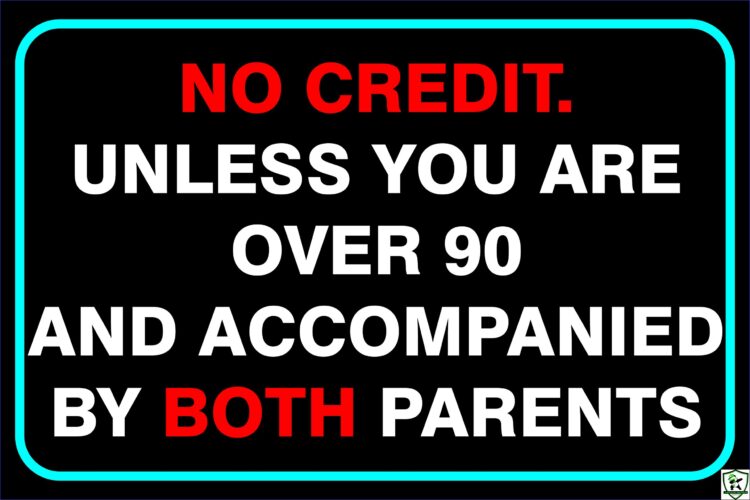

Many of us have encountered the common sign in neighborhood stores that read, “No credit today. Come tomorrow.” Regardless of sentiment, most business experts recommend credit sales as a potentially advantageous business strategy. However, a pressing question arises: Is it sound advice to suggest that a small kiosk owner, whose livelihood hinges on rapid turnovers, should adopt credit sales as a prudent business strategy?

In a recent episode of “Sharing Life Issues,” Mr.Uduak-Obong Nkanta, a financial expert, led us on a journey through the intricate world of selling on credit. According to him, the success of offering credit lies in how it’s delicately handled. When businesses embark on this path, they inevitably encounter customers who request credit, even when it wasn’t part of the plan. This can take various forms – from customers buying goods on credit to those who delay paying for services. Hence, it becomes crucial for business owners to deeply comprehend the essence of their trade. Safeguarding business growth should be their North Star, and a deep understanding of the risks involved becomes their guiding light.

Picture the scene: A start-up decides to venture into offering goods and services with delayed payments as a penetration strategy, primarily targeting the working class – salary earners who, on paper, seem like a safety net due to their predictable monthly incomes. Yet, this preconceived notion often proves itself as a mirage. Some individuals, regardless of their stable income, deliberately default on their payments, defending their actions with the time-worn excuse that they won’t be the first or the last to owe. This script unfolds repeatedly, and the fallout is businesses crumbling like houses of cards.

To prevent business distress or a perilous fall, Mr. Nkanta suggests a prudent approach when negotiating product prices for credit sales. Attach interest to the transaction, and if possible, secure a down payment to safeguard against total loss. The concept of the time value of money should also be factored in. For instance, if a product is sold for 10,000 Naira with a promise of payment in six months, the true value of that 10,000 Naira in six months will differ. A shrewd business owner knows that this money could have been reinvested to generate more income hence the need for interest on every sale on credit. This isn’t an indictment against offering credit but a call for wisdom in its execution.

The next chapter in this saga is the written agreement, a document signed by both parties that meticulously outlines the terms of payment, rendering verbal agreements obsolete. Anyone unwilling to commit to this formalized arrangement isn’t worthy of your trust, regardless of the nature of your business relationship. For customers opting to pay in installments, the timeframe and duration should be etched in stone, and adherence to these terms is non-negotiable. Maintaining a meticulously documented record of all credit sales is essential and relentless reminders to the customer regarding their outstanding debt, communicated through various means, is advisable.

Selling on credit is an intricate dance, a calculated risk. The creditworthiness of the customer is a key consideration and while there’s no guarantee that customers buying on credit will fulfill their obligations, a proactive approach that prioritizes business growth and necessary precautions can mitigate potential damage. Clearly stipulated conditions for credit transactions, along with guidance for customer interactions, are essential to ensure sound credit practices. In the dynamic realm of business, being wise in offering credit becomes a valuable asset.

Written by Maris ‘Damaris’ Iloka.